Heads up! This article contains spoilers for HBO’s The White Lotus, Season 2.

Poor Tanya. Though she was one of the series’ most beloved characters, she repeatedly and haphazardly got herself into serious trouble, especially in Sicily.

In the climactic scene preceding her ultimate demise, Tanya discovers that her husband, Greg, plotted to collect on her fortune by having her killed. Though Tanya somehow shot her way to safety, she ended up dying anyway by falling off a boat and getting a fatal head wound.

This left us wondering:

- Did Greg inherit her assets and get away with his evil plan?

- What could Tanya have done to protect her money and property when she died?

Let’s look at how prenups, wills, trusts, and estate plans factor into inheritance and what Tanya should have done to ensure Greg didn’t get a single dime when she died.

BEFORE getting married, what conversations about MONEY should you have with your partner?

Use this guide to discuss budgets, assets, debts, goals, joints bank accounts and more.

Get the guidePrenups: Infidelity & Death Clauses

First things first, prenups determine who gets what property in the event of a divorce.

In a prenup, you can include a variety of clauses, like a death clause, to keep the prenup in place or point to a will and trust when a spouse dies.

It was clear that Tanya and Greg had a prenup from Episode 2. Greg seemed bothered from the outset of Season 2, and it wasn’t clear why. To make things better between them, Tanya even offered to amend the prenup (or craft a postnup) to make it more rewarding for Greg.

However, Tanya’s offer was moot. We eventually learn that Greg conspired with Sicilians to squeeze Tanya’s riches from her without her even knowing.

Infidelity Clause Voids the Prenup

Some theories were floating around that Tanya & Greg had an infidelity clause in their prenup.

Late in the season, after Tanya and Greg went their separate ways, Tanya tumbled in the hay with a much younger native, but a red light was blinking in the room — possibly coming from a device recording them.

If Tanya and Greg had an infidelity clause (viable in some states), Greg could have cited it in a case to void their prenup, or depending on the clause itself, receive a substantial payment due to her infidelity. Remember that infidelity clauses don’t hold up in no-fault states like California because you don’t need a reason to divorce.

In any case, it turned out that infidelity, or a clause pertaining to it, was the least of Tanya’s problems.

Death Clause Points to Will & Trust

What’s more likely is that a death clause in Tanya & Greg’s prenup either pointed to a separate will and trust, or the death clause in their prenup stated that Greg would receive all of Tanya’s assets in the event of her death during marriage.

In general, the prenup designates certain things as separate and community property. The prenup works in conjunction with a will and trust, if it exists, to determine which family members inherit separate property and which ones inherit community property.

Without a will and trust, a probate court decides how the property is distributed.

Succession differs if you have separate and community property. A prenup can say there are no promises made and are advised to create a will and trust to designate who gets the money.

Inheritance Rules

Here’s a table showing how succession works if no will and trust is in place:

If you die with: |

Here’s what happens with inheritance: |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

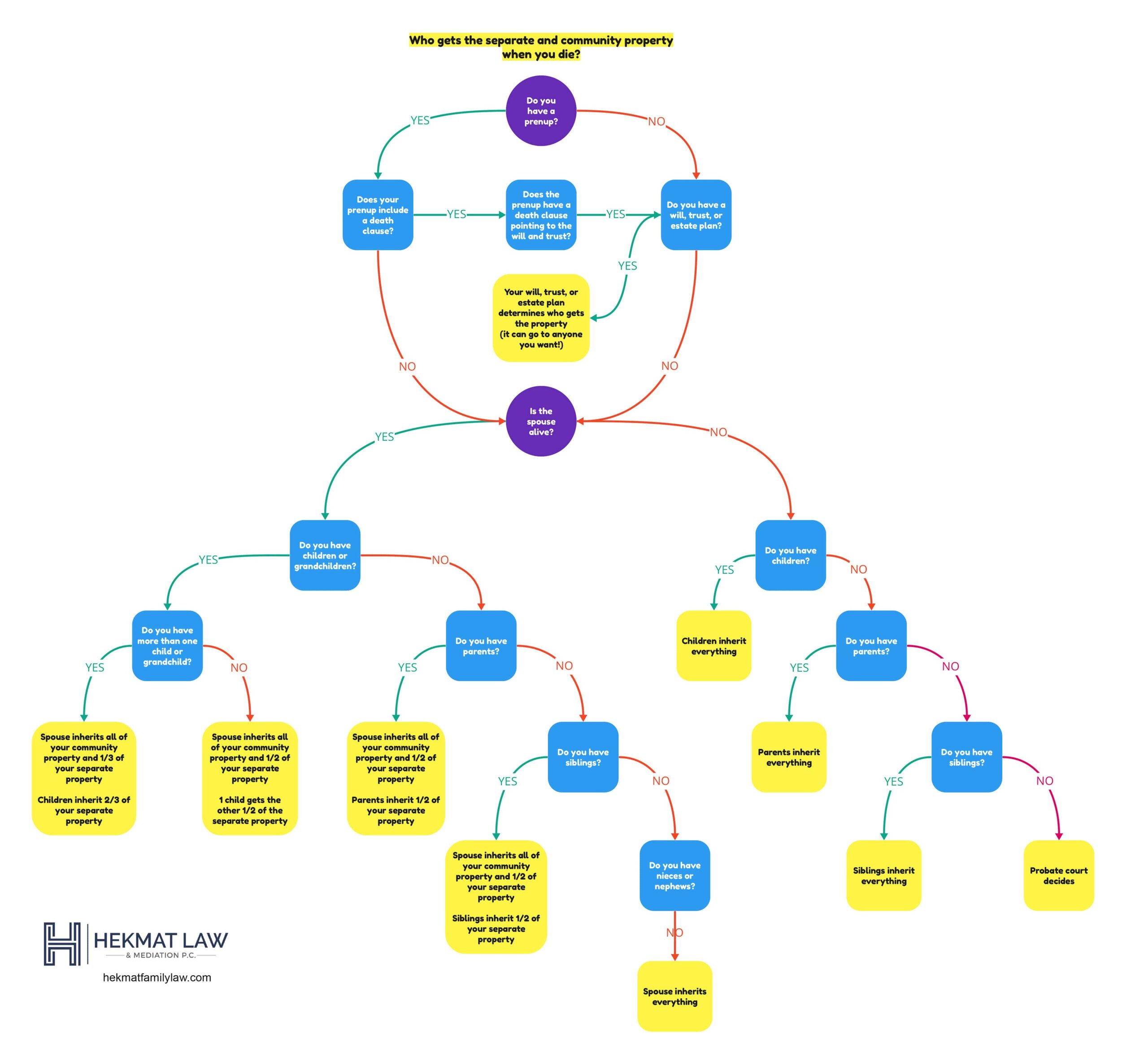

Here’s a flow chart to illustrate how inheritances works when a spouse dies and there is no will and trust in place:

What Should Tanya Have Done to Protect Her Assets?

Tanya should have included a prenup clause that makes no promises to the spouse in the event of her death during marriage, and points to a will & trust upon death stating exactly to whom her assets would go in such an event.

I advise every prenup client to establish a dedicated will and trust that clearly defines who gets the separate and community property. If Tanya had done that, her husband couldn’t exploit inheritance rules.

Does it mean that Tanya wouldn’t find a way to get mixed up in some other drama? Probably not. But it might have given her better peace of mind in knowing that her finances were protected in life and after death.